Open topic with navigation

How Sales Tax is Calculated

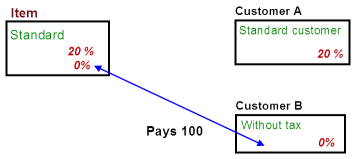

The following example explains what it is that needs to be set up for the sales tax to be calculated for the item in LS POS.

Example: Sales Tax

What is going to be sold:

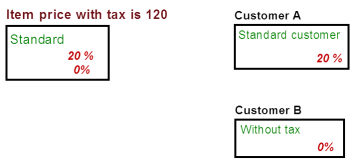

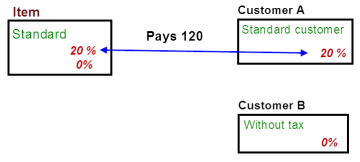

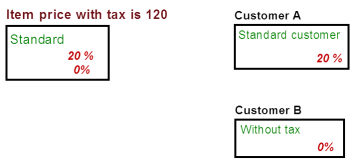

- An item without tax costs 100, with 20% tax it costs 120 and is sold at this price to customer A.

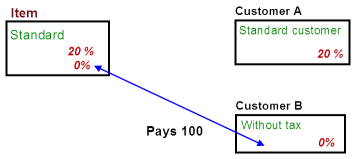

- Customer B is a foreign customer so when he buys the item he pays 100 for it; no tax is paid.

What needs to be set up?

- Two sales tax codes one with 20% and the other with 0% tax.

- An Item sales tax group called Standard which has both of the sales tax codes connected to it.

- The item is in the item sales tax group Standard.

- Two Sales tax groups: Standard customer and Without tax.

- Standard customer adds the 20% sales tax code to it.

- Without tax, adds the 0% sales tax code to it.

- Customer A is configured with the sales tax group, Standard customer.

- Customer B is configured with the sales tax group, Without tax.

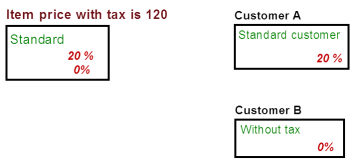

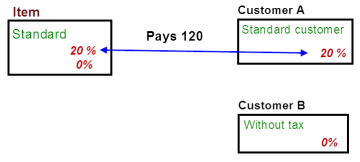

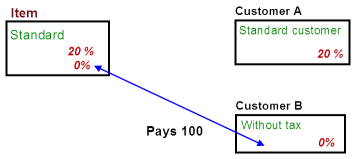

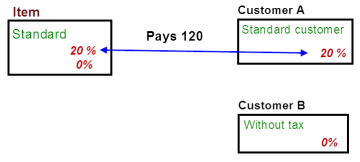

- The setup is shown in the following figure:

- In the LS POS, when customer A buys our item they pay 20% tax since 20% is known by the system as being set both for the customer and the item.

- In the LS One POS, when customer B buys our item they will pay 0% tax since 0% is set to both the customer and the item.

In a real setting, the setup is not as simple as in the example above, but the method is. The sales tax amount is simply triggered in the sale itself depending on the way that it has been set up in the Site Manager.

Note:

For the sales tax to work in the LS POS it is fundamental that each sales line has values for the Item sales tax group and the Sales tax group. If either one is missing, the sales tax cannot be calculated for the sales line.

When the setup in the Site Manager is prepared and set up correctly then the LS POS works automatically regarding sales tax. The LS POS calculates sales tax automatically for a sales lines according to the data.